The Indian stock market plays a vital role in the country’s economy, yet many people find it confusing or intimidating. In reality, once you understand the basics—who participates, how trades happen, and what drives prices—it becomes much easier to grasp.

This blog explains how the Indian stock market works, step by step, in simple terms.

What Is the Indian Stock Market?

The Indian stock market is a platform where shares of publicly listed companies are bought and sold. When you buy a share, you own a small part of that company. Companies raise money from the public by selling shares, and investors aim to grow their wealth over time.

The two main stock exchanges in India are:

-

BSE (Bombay Stock Exchange) – Asia’s oldest stock exchange

-

NSE (National Stock Exchange) – India’s largest exchange by trading volume

Key Participants in the Indian Stock Market

1. Investors

These include individuals, mutual funds, banks, insurance companies, and foreign investors. Investors buy shares to earn:

-

Capital gains (price increase)

-

Dividends (profit sharing)

2. Companies

Companies list their shares on stock exchanges to raise capital for expansion, debt repayment, or new projects.

3. Stockbrokers

Stockbrokers act as intermediaries between investors and the stock exchange. You trade through brokers using:

-

Trading apps

-

Websites

-

Phone-based platforms

4. Regulators (SEBI)

The Securities and Exchange Board of India (SEBI) regulates the stock market to ensure fairness, transparency, and investor protection.

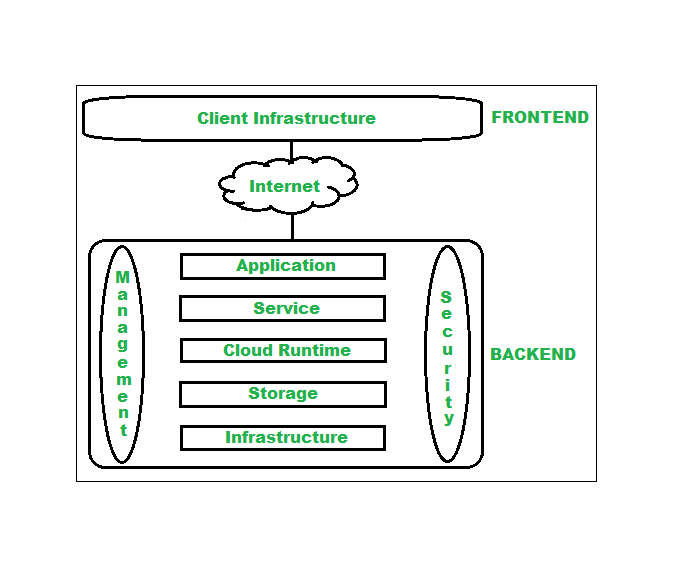

How Shares Are Bought and Sold

Step 1: Open a Demat and Trading Account

To invest in the stock market, you need:

-

Demat account – holds shares electronically

-

Trading account – used to buy and sell shares

Most brokers provide both together.

Step 2: Placing an Order

You place a buy or sell order through your broker:

-

Market order – executed at the current market price

-

Limit order – executed only at a specific price

Step 3: Order Matching

The stock exchange matches buy and sell orders electronically. When prices match, the trade is executed.

Step 4: Settlement

After execution:

-

Shares are credited to the buyer’s Demat account

-

Money is debited from the buyer’s bank account

In India, settlement happens on a T+1 basis (Trade day + 1 day).

Primary Market vs Secondary Market

Primary Market

This is where companies issue shares for the first time through:

-

IPOs (Initial Public Offerings)

Investors buy shares directly from the company.

Secondary Market

This is where existing shares are traded among investors on NSE and BSE. Most daily trading happens here.

What Determines Share Prices?

Share prices change continuously based on:

-

Company performance and earnings

-

Demand and supply

-

Economic indicators (inflation, interest rates)

-

Government policies

-

Global market trends

-

Investor sentiment and news

Simply put, more buyers increase prices, more sellers reduce prices.

Market Indices: Sensex and Nifty

Indices represent overall market performance.

-

Sensex – tracks 30 major companies on BSE

-

Nifty 50 – tracks 50 large companies on NSE

When these indices rise, it generally means the market is performing well.

Different Types of Investors

Long-Term Investors

-

Focus on fundamentals

-

Hold stocks for years

-

Aim for wealth creation

Traders

-

Buy and sell frequently

-

Focus on price movements

-

Includes intraday and swing traders

Both operate in the same market but with different strategies.

Risks Involved in the Indian Stock Market

While the stock market offers good returns, it also involves risks:

-

Market volatility

-

Company-specific risks

-

Economic and political risks

-

Emotional decision-making

This is why knowledge, patience, and discipline are essential.

Why the Indian Stock Market Is Important

-

Helps companies raise capital

-

Allows individuals to grow wealth

-

Reflects the health of the economy

-

Creates employment and innovation

Final Thoughts

The Indian stock market is not gambling—it is a systematic, regulated platform for investing and wealth creation. With the right knowledge, long-term mindset, and risk management, anyone can participate responsibly.